Things are changing fast every day in every field of life. As for the financial industry, the relationship between technology and economic activities is increasingly becoming closer due to the growth of fintech. This intricate intertwining has created a fascinating amalgamation of innovation and tradition.

One of the most intriguing outcomes of this fusion is the emergence of social features within financial services. As individuals worldwide become more interconnected through digital platforms, financial institutions leverage social elements to enhance customer experiences, drive financial literacy, and even reshape how we perceive and interact with money. These elements are generally in the features of banking websites, apps, or other financial service sites such as insurance and investment.

Today’s financial institutions do not just want websites and apps to be accessed as just the usual place to conduct transactions, and they have an enormous ambition to make these locations a more intimate tool with many valuable features to interact with their customers. That is also why introducing social interaction features on banking, insurance, investment, or other financial websites or apps.

So, first of all, we will dive into the top 06 favorable app social features in financial web and mobile apps.

Chatbot

Among the most cherished and essential functionalities, most users favor is the chat feature. This attribute finds its application within social platforms and enjoys widespread usage across numerous apps and websites, primarily to deliver immediate customer support. In the financial field, the ability to assist users in resolving issues and addressing personal queries is paramount.

Forums and Communities

Creating discussion forums or communities where users can interact, share experiences, ask questions, and provide insights on financial topics fosters a sense of belonging and encourages knowledge sharing.

Peer-to-Peer Interactions

Enabling users to connect with friends, family, or colleagues to split bills, share expenses, or contribute to joint financial goals enhances collaborative financial management. This feature fosters seamless interactions, allowing users to tackle financial tasks collectively. Whether sharing a dinner bill or saving for a group vacation, peer-to-peer interactions create a sense of financial teamwork and make managing shared finances hassle-free.

Rewards and Points

The concept of utilizing rewards such as points and vouchers via your mobile banking app for purchases presents a novel approach, one that is poised to gain traction as consumers seek to maximize their spending power in times of economic uncertainty. This feature also helps enhance users’ engagement with the financial institutions that urge them to spend more time and effort using apps or websites, leading to more value.

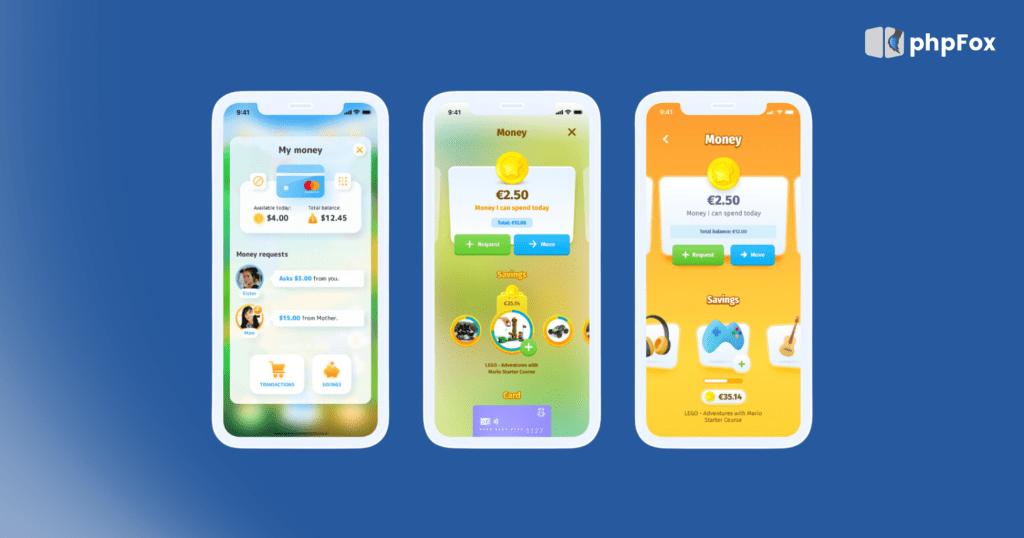

Gamification

Adding gamification elements to financial apps introduces an interactive and engaging dimension. Users are motivated to achieve financial milestones, earn rewards, and compete with others, making financial management feel more enjoyable and attainable. This feature can increase engagement with seasonal programs based on crucial occasions or holidays.

Referral Programs

Including referral programs within financial apps and services allows users to refer friends and family to the platform, earning rewards for successful referrals. This feature encourages user growth and nurtures a sense of community engagement. Users are motivated to spread the word about the app, benefiting themselves and their acquaintances. As referrals increase, so does the app’s user base, creating a win-win scenario that fosters a sense of camaraderie among users while expanding the app’s reach and impact.

How do social features leverage interactions and networks in financial services?

With these outstanding categories of social features, customers’ experience of financial platforms can be further enhanced and achieve more value for both sides. Here’s how social features leverage interactions and networks in financial services:

Customer Engagement and Communication

Social features enable direct and real-time communication between financial institutions and their customers. This can be through instant messaging, chatbots, or interactive forums. Customers can ask questions, seek advice, and resolve issues more efficiently, fostering a sense of trust and transparency. Furthermore, community features in these platforms help users build their networks with others.

Personalized Financial Insights

Social features facilitate the sharing of financial experiences and goals. This allows for personalized insights and recommendations based on user profiles and preferences. Also, financial institutions can provide personalized recommendations for using enhancement of each user.

Emotional Support and Motivation

Financial challenges can be daunting. Social features provide emotional support by connecting users facing similar situations. Users can share experiences, motivate one another, and tackle financial goals collectively.

Real-time Market Sentiment Analysis

Financial institutions analyze social sentiment to gauge public perception of financial products and market trends. This information aids decision-making and risk assessment by understanding the public view.

Building Trust and Brand Loyalty

Transparent interactions through social features contribute to building trust between users and financial institutions. Enhanced engagement leads to increased brand loyalty as users feel valued and connected.

Financial institutions’ platforms with social features

Robinhood: A popular investment platform with a built-in chat feature that provides real-time customer support and assistance related to trading, investments, and account management.

Acorns: This micro-investing app offers a chat feature where users can ask questions about investing strategies, portfolio management, and other financial topics.

Betterment: An online robo-advisor that offers a chat feature for users to communicate with financial experts and get personalized advice on investment goals and portfolio allocation.

Splitwise: While not exclusively a financial app, Splitwise allows users to split bills and expenses with friends and groups, making it easier to manage shared finances.

Chime: A neobank app with a chat option for customer support and assistance with banking-related inquiries, transactions, and account management.

Venmo: A popular peer-to-peer payment app that allows users to send money to friends, split bills, and make payments for shared expenses.

Cash App: Similar to Venmo, Cash App enables peer-to-peer money transfers, splitting bills, and even investing in stocks and Bitcoin.

Zelle: A service integrated with many major banks that enables direct person-to-person payments and money transfers.

Challenges and Considerations

Particular challenges and considerations come to the forefront in the realm where financial services intersect with social features. As we explore the benefits of these innovations, it’s crucial to acknowledge and address potential hurdles that can arise.

Data Privacy and Security

Incorporating social features into financial services raises essential data privacy and security concerns. Users rightly worry about exposing their financial data to unauthorized access, identity theft, or cyberattacks. To mitigate these risks, stringent security measures must be in place. Financial institutions must adhere to strict regulatory frameworks to ensure user data is collected, stored, and processed securely. Robust encryption, multi-factor authentication, and regular security audits are integral to maintaining user trust in the face of evolving cybersecurity threats.

Overcoming Information Overload

The proliferation of information within social platforms can lead to a phenomenon known as information overload. Users engaging with various financial discussions and content might need more clarification and a barrage of opinions. They must develop a discerning approach to consuming information to navigate this challenge. Financial institutions can play a role by providing curated content and educational resources. Additionally, integrating AI-driven algorithms can help users filter and prioritize relevant information, tailoring recommendations based on their financial goals and risk tolerance. By balancing information dissemination and tailored guidance, financial platforms can empower users without overwhelming them with the necessary insights.

Conclusion

While incorporating social features into financial services holds immense promise, it’s imperative to acknowledge the challenges accompanying this evolution. Proactively addressing these concerns and challenges ensure that users can confidently engage with these features while safeguarding sensitive financial information; the financial industry can maximize the benefits of social features while minimizing the associated risks. As we embrace the potential and navigate the challenges, let us anticipate a future where financial interactions are not only efficient but also significant, where financial institutions don’t just provide services but foster connections.

🔑 Any questions related to phpFox? Contact us via Client Area or email us at hello@phpfox.com